Tony Robbins Says Everyone Should Do This with Their Money Before Turning 30

As we start to enter the workforce and earn our own money, it’s hard to know the right path to take. But, according to Tony Robbins, there’s some important steps to be taking before we hit 30.

Robbins recently told CNBC there are two essential steps to take to be in good shape for your future.

Invest

“Are you a consumer or are you an owner? You are not on target unless you become an investor. You don’t want to just buy an Apple phone — you want to own Apple.”

Now, of course he doesn’t necessarily mean buying stocks at Apple, but he recommends investing in index funds, so you can have a small stake in lots of companies. You can also contribute to a 401(k) plan or retirement savings accounts. This will open the door to compound interest, which can lead to future wealth.

Automate your contributions

The goal is to get to the level where “the income that you get off those investments will allow you to live the life you have today without working,” says Robbins. One way to do this is to automate your investments —so that is when your employer may do a paycheck deduction or you can have money taken out of your checking account and transferred to an investment account. “I don’t care what age you are, if you don’t automate it, you’re not going to get there,” says Robbins. This takes away even having the option of spending that money. Also, if you don’t see the money, you’ll learn to live without it.

Most people say, ‘I don’t have any money to invest. I can’t put the money aside to do that,’” says Robbins. “You have to decide that a certain amount of money that you make is going to be yours to keep,” says Robbins, “and that you’re going to be an owner — an investor — not merely somebody that’s constantly struggling to buy more things.”

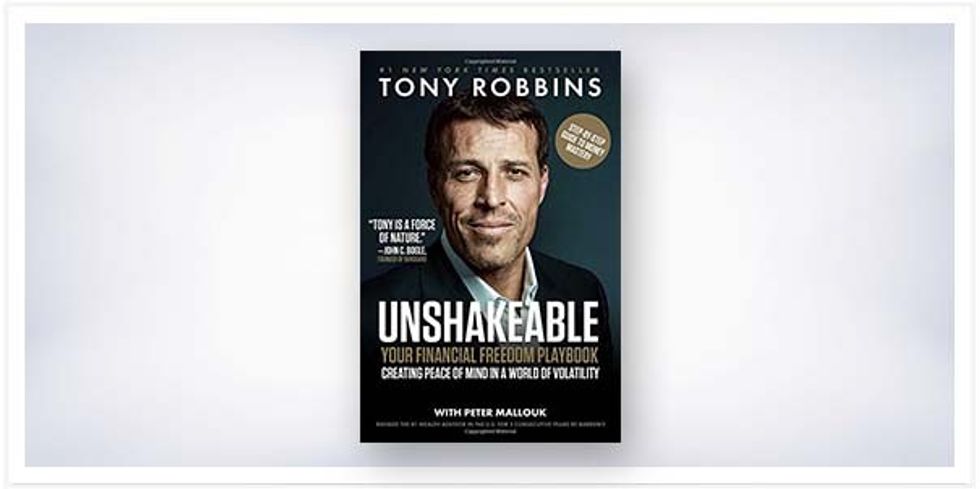

Unshakeable: Your Financial Freedom Playbook

Still curious about whether or not your personal finances are on track? We recommend Tony Robbins' "Unshakeable: Your Financial Freedom Playbook".

RELATED READING:

Old photobooth strip of Nana and Papa@jennjensc/TikTok

Old photobooth strip of Nana and Papa@jennjensc/TikTok An elderly woman sits in chair with blue blanket while doing chemotherapy.@jennjensc/Tiktok

An elderly woman sits in chair with blue blanket while doing chemotherapy.@jennjensc/Tiktok screenshot of a comment on TikTok@jennjensc / TikTok

screenshot of a comment on TikTok@jennjensc / TikTok